Tax Incentive Resources

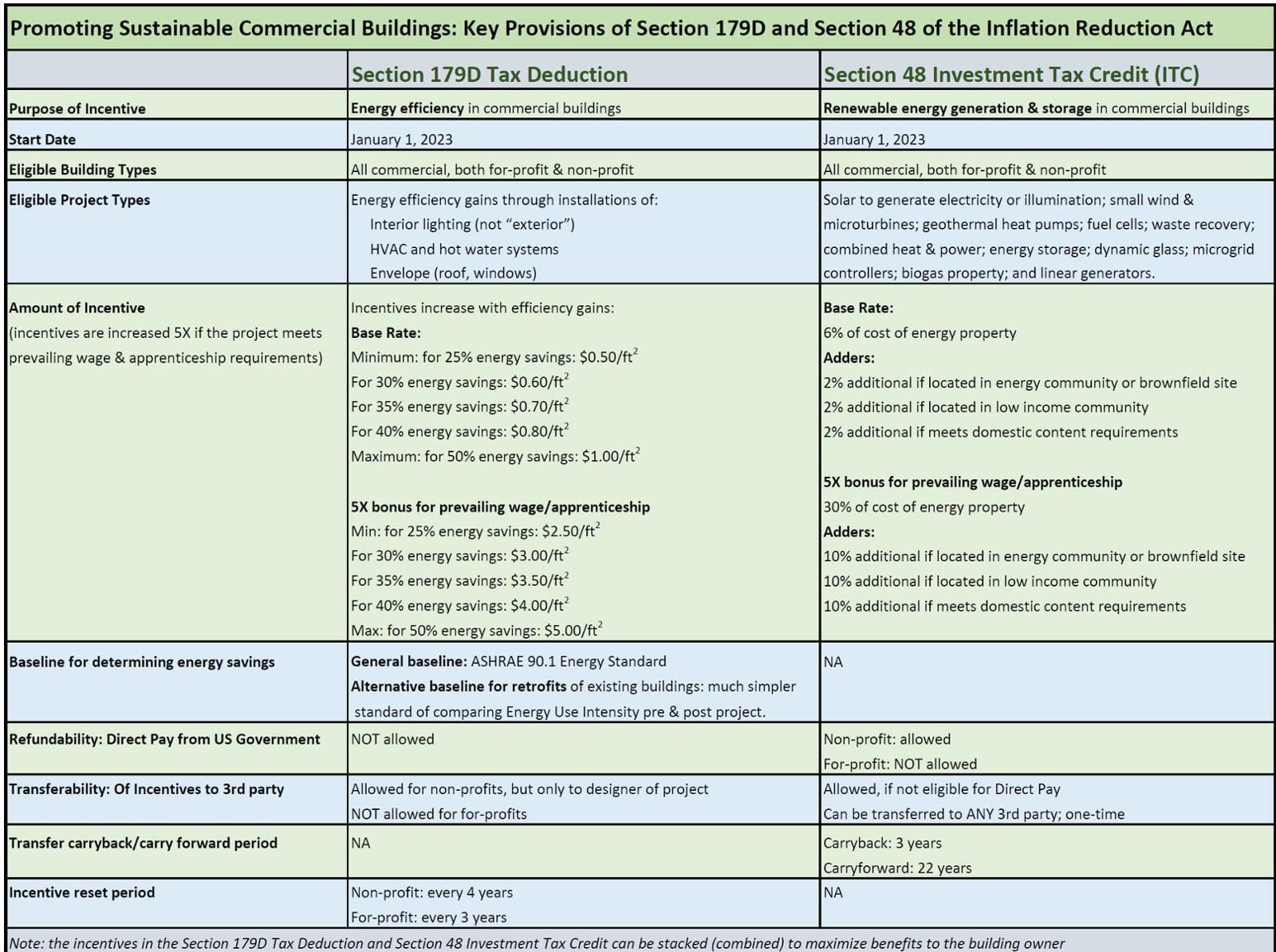

The key provisions in the IRA affecting building owners are the Investment Tax Credit (ITC) for renewables projects and Section 179D for energy efficiency improvements.

The difference between these two incentives can be confusing, so we have compared the two side-by-side below. Click here to learn more about the refundability and transferability of these incentives.

In addition to the core benefits of the ITC and and Section 179D, there are several other new or revised IRA tax incentives, state, local and utility incentives that can help certain building owners:

- Sec 45L for multifamily building energy efficiency

- Sec 30C for EV charging stations in low income areas

- MACRS depreciation for renewables

- State, local and utility incentives

Learning Center > C-PACE Resources | Tax Incentive Resources | News and Whitepapers