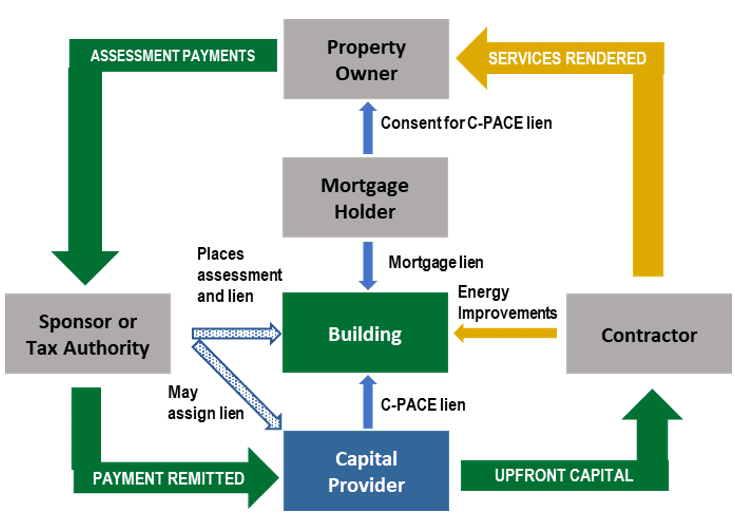

How C-PACE Works

What is C-PACE?

“C-PACE” stands for “commercial property assessed clean energy”. C-PACE finances energy efficiency upgrades, renewable energy installations such as solar, disaster resiliency improvements, and water conservation measures for commercial and non-profit property owners. C-PACE is unique as a mechanism to provide low-cost, long-term financing. It is a national public-private initiative, supported and promoted by the U.S. Department of Energy, but C-PACE is not a federal program, and public funding is not used to fund C-PACE programs. Rather, C-PACE was conceived as a means to attract private funders, such as PowerGreen Capital, into the clean energy market.

A C-PACE financing program must first be enabled by legislation at the state level, and subsequently authorized at the county or local municipal level. Currently 37 states have enabled C-PACE, including the Mid-Atlantic states of Pennsylvania, New York and New Jersey.

What are the benefits of C-PACE?

Many buildings need upgrading, but until C-PACE, building owners lacked a cost-effective way to pay for it. C-PACE provides 100 percent financing that is long-term, non-recourse, and affordable.

In fact, the energy cost savings from C-PACE improvements usually exceed the financing costs, so C-PACE from PowerGreen Capital is self-financing.

Moreover, the financing is based on the building’s financial health, so the owner is not required to sign a personal guarantee.

Upon completion, the building owner has a more valuable, more competitive building, healthier and more productive employees or tenants, and lower utility bills.

What is the C-PACE process?

Is my building eligible for C-PACE?

- Commercial

- Industrial

- Multifamily (with 5 or more units)

- Non-profit

New construction projects are also eligible for C-PACE financing. In addition, energy efficiency and renewable energy projects that have been completed within the past two or three years (depending on the state) are eligible for retroactive C-PACE financing.

Is my project eligible for C-PACE?

A wide range of improvements are eligible for C-PACE financing, including energy efficiency, renewable energy & storage, resiliency, and water efficiency.

Improvements that are eligible for C-PACE financing must be permanently affixed to the building.

Learn more about eligible improvements.

What is the timeline for a C-PACE financing?

- confirmation that the project’s improvements are eligible for C-PACE financing,

- the energy audit for energy efficiency projects,

- a feasibility study for renewable energy projects, and

- lender consent for the transactions

- PowerGreen Capital's internal underwriting to ensure the building owner and the project satisfy their internal guidelines.

What is the term and cost of a C-PACE financing?

One of the great benefits of C-PACE financing is that term is matched to the average useful life of the improvements. This means long term, fixed rate financing for from 15 to 30 years. The financing rate is typically a spread of 350 to 450 basis points over 20-year U.S. Treasuries. The actual rate is based on market conditions.

Please contact PowerGreen Capital today to start a conversation about upgrading your building with C-PACE.

Learning Center > C-PACE Resources