For Renewables and (Now) Storage,

The Investment Tax Credit is Better Than Ever

The Inflation Reduction Act (IRA) of 2022 has brought game-changing revisions to the federal tax incentives for renewable energy projects, especially solar and battery storage.

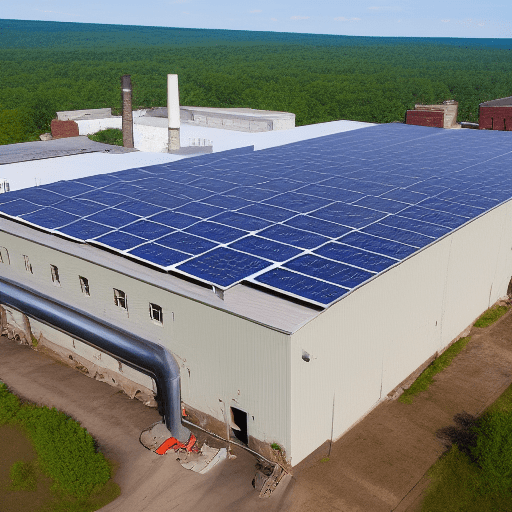

The IRA has restored the Solar Investment Tax Credit (ITC) to 30% for both residential and commercial customers, extended it for 10 years and expanded it to include stand-alone energy storage devices. These provisions can help commercial building owners reduce their upfront costs and increase their returns on investment when installing solar and battery storage systems.

Moreover, after deducting the 30% ITC, building owners can use C-PACE financing from PowerGreen Capital to cover 100% of the remaining project cost. This means building owners can now green light that solar plus storage project at a significantly reduced cost and with no money out of pocket.

The ITC is a dollar-for-dollar reduction in federal income taxes for eligible taxpayers who invest in qualified solar energy property. The ITC applies to both purchased and leased systems, as long as the taxpayer owns the system or has a capital lease. The ITC can be claimed in the year that the system is placed in service or construction begins, whichever comes first.

Before the IRA, only batteries that were charged by solar panels were eligible for the ITC, which limited their usefulness for commercial customers who wanted to use them for demand charge management, backup power, or grid services. The IRA has removed this restriction and allowed stand-alone storage devices to qualify for the ITC. This means that commercial building owners can now install batteries without solar panels and still get a 30% tax credit on their cost.

The combination of solar and battery storage can provide multiple benefits for commercial building owners, such as:

- Lowering their electricity bills by generating clean power during peak hours and storing excess energy for later use

- Reducing their demand charges by discharging stored energy during periods of high demand

- Increasing their resiliency by having backup power in case of grid outages

- Earning additional revenue by participating in demand response programs or providing ancillary services to the grid

- Enhancing their environmental performance by reducing their carbon footprint and supporting renewable energy integration

The new ITC provisions make it easier and more affordable for commercial building owners to finance the installation of solar and battery storage systems. By taking advantage of this opportunity, you can improve you bottom line, increase you property value, and contribute to a cleaner and more resilient energy future.

To learn more about how to maximize the value of tax incentives for your renewable energy project, contact PowerGreen Capital today.

Commercial Building Owners > Benefits | C-PACE | Tax Incentives | ITC for Renewables | 179D for Energy Efficiency